Engineering Skills Gap Analysis for Scotland

This skills gap analysis for engineering and manufacturing roles in Scotland stemmed from discussions held by the Skills Leadership Sub-Group of the Aerospace, Defence and Space Industry Leadership Group (ILG). By identifying a lack of objective data that could accurately forecast the skills gaps resulting from both expected retirements, and expected business growth and diversification, this report aims to allow industry and government to work in partnership to maximise the opportunities for the Scottish Economy and its society as a result.

These results are the output from a survey of 70 engineering companies based on their operations in Scotland, and representing 10,169 employees or approximately 6% of the sector. Of the thirty-one roles surveyed, seven are those that may typically (but not exclusively) be considered as degree qualified, whilst the remaining twenty-four roles are the output of apprenticeships and work-based learning.

The survey achieve broad sectoral representation, with companies from the following sectors represented: Defence, Aerospace, Space, Food and Drink, Automation, Electronics, Biomedical, Automotive, Precision Manufacturing, Plastics Manufacturing, Fabrication, Equipment Manufacturing, Energy, Digital Engineering, Electrical equipment, Consumer goods; Battery Manufacturing, Foundry and Forging, Mining and Quarrying, Food Manufacturing equipment, Marine Engineering, Logistics, Packaging, Coating Technologies.

Survey Results

In considering the need for both replacement for expected retirements, and additions for business growth, the total cumulative demand across all thirty-one Engineering roles by year is shown below

This summary states that for the averaged demand across these thirty-one roles, industry will require an additional:

33% of the volume currently in role in industry by the end of 2025

46% of the volume currently in role in industry by the end of 2026

58% of the volume currently in role in industry by the end of 2027

Cumulative % to be added or replaced by 2027 (1)

Cumulative % to be added or replaced by 2027 (2)

Cumulative % to be added or replaced by 2027 (3)

Cumulative % to be added or replaced by 2027 (4)

Cumulative % to be added or replaced by 2027 (5)

For each role, we also captured the intention to train required staff in-house for each of the years demand. For these responses the results can be understood by considering that where a skilled technician role is required in three years’ time, to train from scratch for such a role will take between four and six years to be competent, and so unless the company has started the training already, that resource will not be ready at the time of need.

The graph mapping the percentage of plan to train in-house by each year is shown below:

The demand and plan to train responses make for stark gaps across the board, but particular examples and roles stand out as follows:

- Seventeen of the Thirty-One roles have an intent of 50% or less planned to train in house over the period to the end of 2027

- For Skilled welders by the end of 2027 there is a cumulative 66% demand, with a correlated 28% plan to train by each year

- For Instrumentation and control engineers, by the end of 2027 there is 134% demand with a 32% plan to train by each year

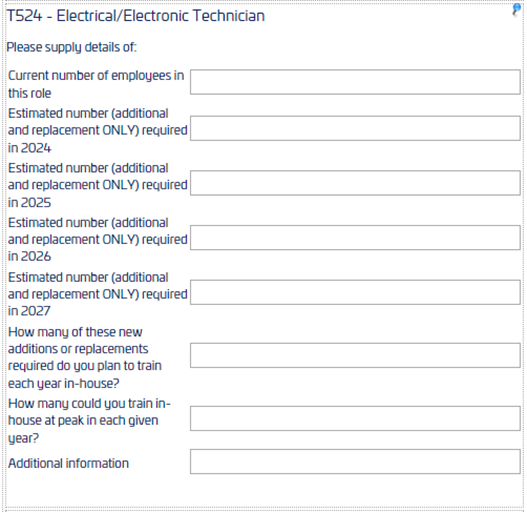

- For Electrical/Electronic Technicians, by the end of 2027 there is a 147% demand, with a 24% plan to train by each year

Inward Investement Contect

These survey results are for existing incumbent industry only, and so do not include any allowance for:

- Offshore wind growth through business diversification and growth as well as inward investor operations considering setting up business for this opportunity

- Grid Infrastructure investment for energy transmission upgrade for clean energy readiness

- Decarbonising heat energy and green hydrogen production

Looking ahead to the positive opportunities of inward investment related to these activities, the challenging additional demand on skills shortages becomes a deep concern, given that such opportunities are not currently mapped in this gap analysis.

In addition, the recent example of an inward investor in the Aerospace cluster around Prestwick resulted in very a difficult situation where the unfulfilled demand for the arriving company resulted in steep “wage-flation” and losses of critical staff to incumbent industry, with no active plan or investment to offset the impact of the opportunity.

Conclusion

The skills pipeline gaps for these roles are an immediately stark situation, and this is only for existing industry, with no allowance for the additional demands outlined. Where that demand is for the opportunity for inward investment, unless there is a rapid change in the required skills investment there is a considerable risk of damage to incumbent industry. Alongside this, there is also risk to inward investors of failure to reach the skilled staffing levels they require, with negative impact on their projects, and reputational risk to Scotland’s ability to accommodate such opportunity.

To offset these potential impacts, this report recommends consideration to three levels of action for engineering skills:

- Change the current split of education and skills funding to meet the actual demand for apprentice training programmes provided to industry by Colleges and Training Groups. This year we estimate that 20% of demand has been unmet due to real terms funding cuts to apprenticeships in Scotland

- Incentivise SMEs to increase the number of apprenticeships starts, as this is the industry cohort who have capacity to increase if supported

- Consider the use of group and shared apprenticeships to ensure that what spare capacity exists is utilised to deliver resource to close these gaps

Sample Questions Asked In The Survey